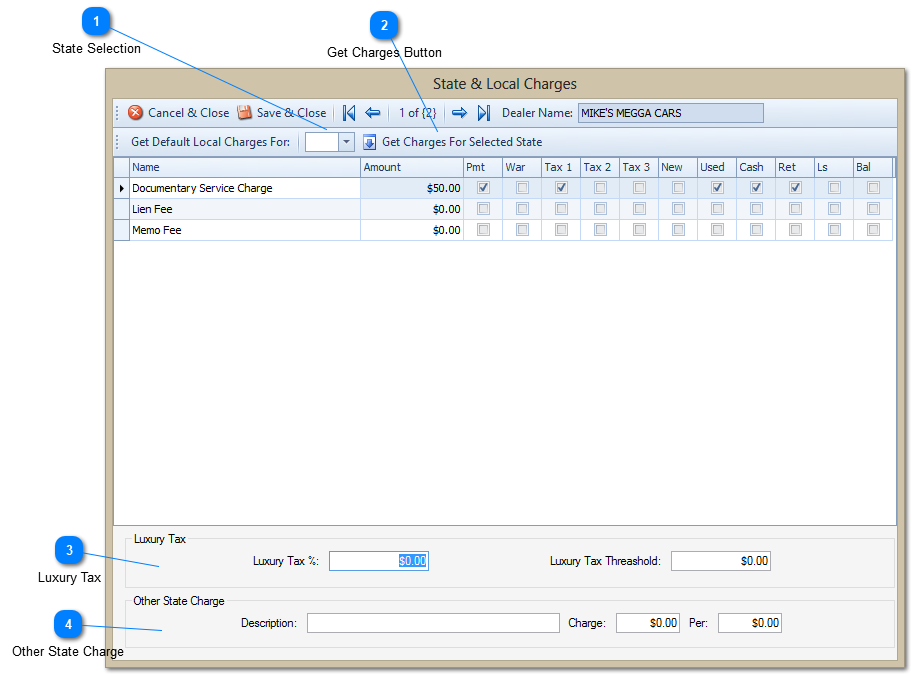

State & Local Charges

Charges are set up at the ComSoft main office. They represent different fees and charges that are associated with each state. By default this list is empty. To get the current list for your state select the state for which

you wish to get the list in the state selection drop down. Once the state is selected click on the "Get Charges For Selected State" button and the list will be populated from ComSoft's servers. The names can be changed

but what the charge represents in that location cannot. That is because when forms are programmed the amounts for the fees are expected to be in the default location in the list. We suggest that you leave the charges with

the same name. Dollar amounts must be added for each fee. Select the check box for each tax if the charge is taxable by that entity.

Tax 1 = State Tax

Tax 2 = County Tax

Tax 3 = City Tax

ComSoft DMS has the ability to charge up to 6 different tax rates. In some states the tax rate charged on a vehicle must be the rate for which the customer lives but the tax rate charged on extended warranties or service

contract must charge the rate for which the dealer is located. In other states this rate is the same.

The "War" check box determines if the warranty rate is to be charged or not.

The next set of check boxes, "New" and "Used" determine if this charge pertains to a new vehicle or a used vehicle. If the charge only pertains to a used vehicle then check the used check box only. When a deal is begun and

a used vehicle selected from inventory this charge will be applied.

The check boxes "Cash", "Ret", "Lse", and "Bal" pertain to deal types.

Cash = Cash Deal

Ret = Retail Deal

Lse = Lease Deal

Bal = Balloon Deal

Check the check boxes of the deal types that the charge is applied to.

Finally the "Pmt" check box determines if the charge will be included in the amount financed by default or not.

The settings on this screen determine what the deal defaults will be in terms of charges or local fees. Taxability, amount financed, and dollar amounts can be changed at the deal level.